charitable gift annuity canada

Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

He receives tax-free payments of 2250 annually for the rest of his life.

. The charitable gift annuity is a popular planned giving instrument for elder Canadians as it allows a person to make a significant contribution. Our mission is to promote and facilitate giving by individuals and organizations while. Charitable Gift Annuities will give you many benefits.

A guaranteed stream of virtually tax-free income for life. Ad Get this must-read guide if you are considering investing in annuities. A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor andor another person or.

A 70-year-old donor makes a 50000 contribution to UAlberta for a charitable gift annuity. A charitable gift annuity is an arrangement under which a donor transfers capital to a charitable organization in exchange for immediate guaranteed payments for life at a specified rate. A charitable gift annuity is known as a gift that gives back.

That is a portion may. A charitable gift annuity provides you with fixed payments for life in exchange for a gift of cash or securities. Ad Annuities help you safely increase wealth avoid running out of money.

Ad Get this must-read guide if you are considering investing in annuities. This arrangement enables you to. Learn some startling facts.

As with any other. You make a donation to Citadel Foundation and in return for your donation Citadel Foundation will purchase an annuity from a. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year.

Get your exclusive free annuity report. Let us help you get started. His charitable gift to.

A Charitable Gift Annuity allows individuals and couples with a higher than average investment income to. Gift Funds Canada is a registered charitable public foundation with the Canada Revenue Agency CRA. A gift to NCC for which you will receive a tax receipt.

A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life. Simply put an annuity consists of two parts. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Charitable Gift Annuity. It is a thoughtful gift that gives back. It also serves to establish monitor ethical financial standards that reflect the requirements of the Canada Income Tax Act for receiving donations through gift annuities life income gift.

A Gift That Gives Back I was very fortunate to participate at one of Canadas most thought-provoking and stimulating annual events. Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. Learn some startling facts.

Ad The Leading Online Publisher of National and State-specific Gift Legal Documents. At the end of life the remainder of your annuity capital becomes a gift for your favourite charities. A Charitable Gift Annuity is a gift vehicle that when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime.

In June I was honoured when. Annuities are often complex retirement investment products. Annuities are often complex retirement investment products.

The remainder is used to further the mission of Brandeis University. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. A charitable gift annuity provides an immediate gift to CD.

Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. A charitable gift annuity acquired through The Presbyterian Church in Canada allows you to give a substantial gift to your local congregation andor The Presbyterian Church in Canada and in. Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans.

The payment rate for joint gift annuities is lower than the rate. A 75-year- old who establishes a charitable gift annuity after July 1 2020 will receive an annual payout of 54 which is down from 58 on January 1 of this year. Describing what the gift annuity accomplishes.

A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the donor for the. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Depending on the donors age this.

A Charitable Gift Annuity Provides Tax Savings And Pays You Back For Life. Howe Institute while providing a secured income stream for the donor during their lifetime.

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

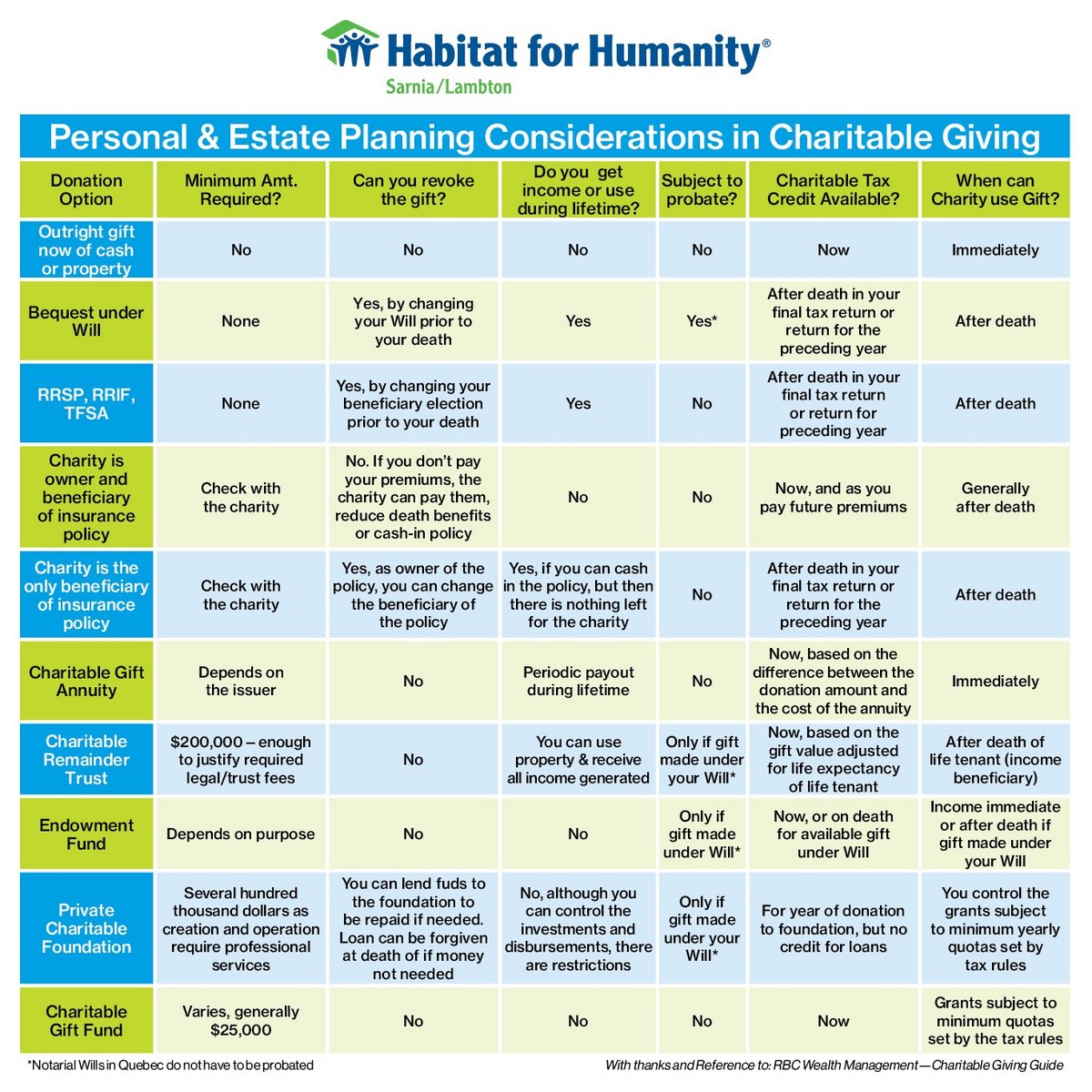

Planned Giving Habitat For Humanity Sarnia Lambton

Charitable Gift Annuities Studentreach

Planned Giving Habitat For Humanity Sarnia Lambton

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Charitable Bequest And The Charity Child The Christian School Foundation

Canadian Charitable Annuity Association

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuity Partners In Health

Charitable Gift Annuity The Christian School Foundation

Annuity Broker Canadian Annuity Broker Lifeannuities Com

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Charitable Gift Annuity Focus On The Family

Gift Estate Planning Sfu Advancement Alumni Engagement

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge